This is “Comparison of Job Costing with Process Costing”, section 4.1 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

4.1 Comparison of Job Costing with Process Costing

Learning Objective

- Compare and contrast job costing and process costing.

Question: A process costing systemA system of assigning costs used by companies that produce similar or identical units of product in batches employing a consistent process. is used by companies that produce similar or identical units of product in batches employing a consistent process. Examples of companies that use process costing include Chevron Corporation (petroleum products), the Wrigley Company (chewing gum), and Pittsburgh Paints (paint). A job costing systemA system of assigning costs used by companies that produce unique products or jobs. is used by companies that produce unique products or jobs. Examples of companies that use job costing systems include Boeing (airplanes), Lockheed Martin (advanced technology systems), and Deloitte & Touche (accounting). What are the similarities and differences between job costing and process costing systems?

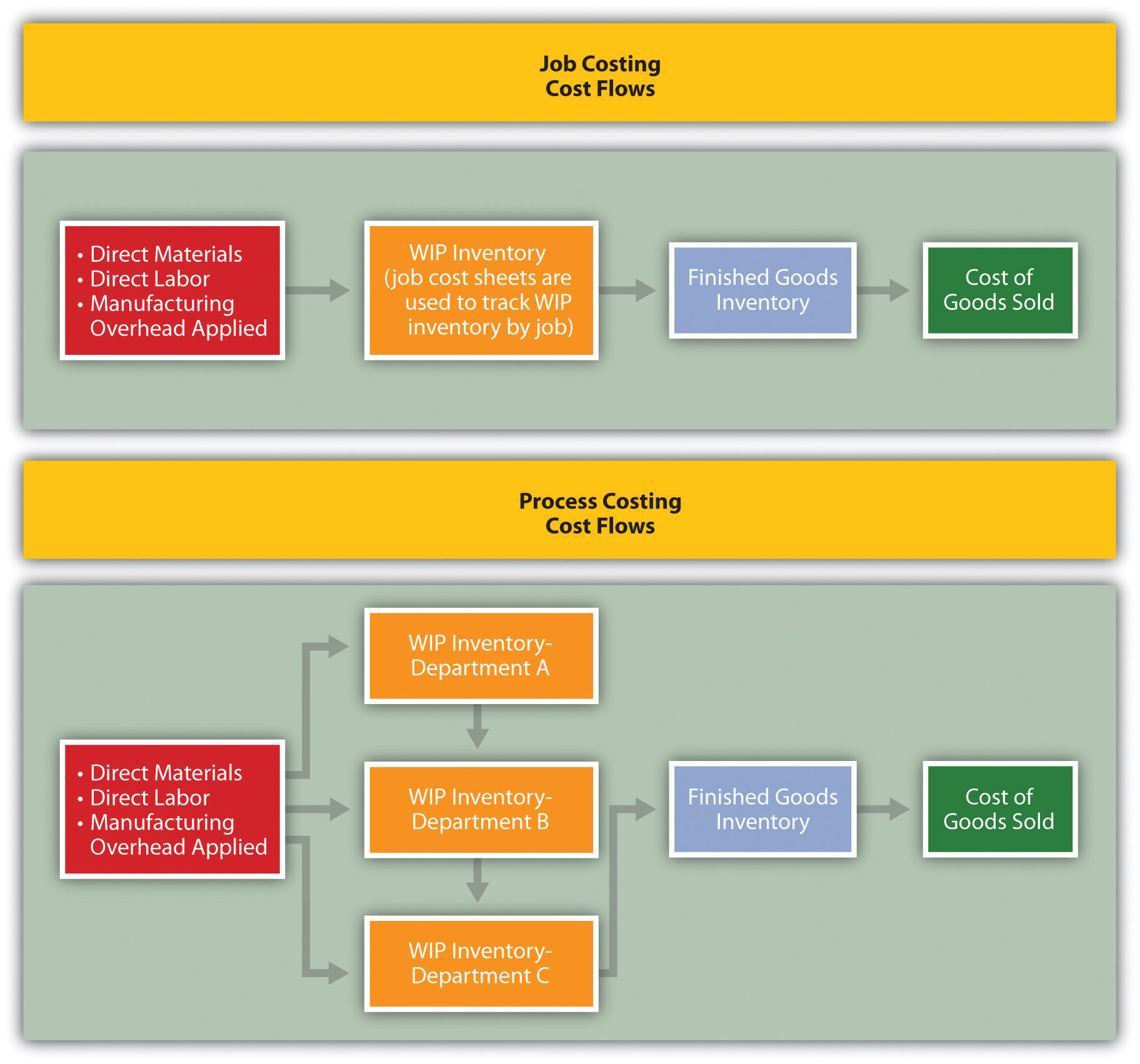

Answer: Although these systems have marked differences, they are also similar in many ways. (As you read through this section, refer to Chapter 1 "What Is Managerial Accounting?" for a review of important terms if necessary.) Recall the three inventory accounts that accountants use to track product cost information—raw materials inventory, work-in-process inventory, and finished goods inventory. These three inventory accounts are used to record product cost information for both process costing and job costing systems. However, several work-in-process inventory accounts are typically used in a process costing system to track the flow of product costs through each production department. Thus each department has its own work-in-process inventory account. (For the purposes of this chapter, assume each department represents a production process. This explains the term process costing because we are tracking costs by process.) The sum of all work-in-process inventory accounts represents total work in process for the company.

Recall the three components of product costs—direct materials, direct labor, and manufacturing overhead. Assigning these product costs to individual products remains an important goal for process costing, just as with job costing. However, instead of assigning product costs to individual jobs (shown on a job cost sheet), process costing assigns these costs to departments (shown on a departmental production cost report).

Figure 4.1 "A Comparison of Cost Flows for Job Costing and Process Costing" shows how product costs flow through accounts for job costing and process costing systems. Table 4.1 "A Comparison of Process Costing and Job Costing" outlines the similarities and differences between these two costing systems. Review these illustrations carefully before moving on to the next section.

Figure 4.1 A Comparison of Cost Flows for Job Costing and Process Costing

Table 4.1 A Comparison of Process Costing and Job Costing

| Product Costs | ||

| Similarities | Product costs consist of direct materials, direct labor, and manufacturing overhead. | |

| Differences | Process Costing | Job Costing |

| Product costs are assigned to departments (or processes). | Product costs are assigned to jobs. | |

| Unit Cost Information | ||

| Similarities | Unit cost information is needed by management for decision-making purposes. | |

| Differences | Process Costing | Job Costing |

| Unit cost information comes from the departmental production cost report. | Unit cost information comes from the job cost sheet. | |

| Inventory Accounts | ||

| Similarities | Inventory accounts include raw materials inventory, work-in-process inventory, and finished goods inventory. | |

| Differences | Process Costing | Job Costing |

| Several different work-in-process inventory accounts are used—one for each department (or process). | One work-in-process inventory account is used—job cost sheets track costs assigned to each job. | |

Business in Action 4.1

Source: Photo courtesy of Simon Berry, http://www.flickr.com/photos/bezznet/3105213435/.

The Production Process at Coca-Cola

The Coca-Cola Company is one of the world’s largest producers of nonalcoholic beverages. According to the company, more than 11,000 of its soft drinks are consumed every second of every day.

In the first stage of production, Coca-Cola mixes direct materials—water, refined sugar, and secret ingredients—to make the liquid for its beverages. The second stage includes filling cleaned and sanitized bottles before placing a cap on each bottle. In the third stage, filled bottles are inspected, labeled, and packaged.

Work in process begins with the first stage of production (mixing and blending), continues with the second stage (bottling), and ends with the third stage (inspecting, labeling, and packaging). When products have gone through all three stages of production, they are shipped to a warehouse, and the costs are entered into finished goods inventory. Once products are delivered to retail stores, product costs are transferred from finished goods inventory to cost of goods sold.

Source: Coca-Cola Company, “Home Page,” http://www2.coca-cola.com/ourcompany/bottlingtoday.

Key Takeaway

- A process costing system is used by companies that produce similar or identical units of product in batches employing a consistent process. A job costing system is used by companies that produce unique products or jobs. Process costing systems track costs by processing department, whereas job costing systems track costs by job.

Review Problem 4.1

Identify whether each business listed in the following would use job costing or process costing.

- Trash bag manufacturer

- Custom furniture manufacturer

- Shampoo manufacturer

- Automobile repair shop

- Sports drink manufacturer

- Antique boat restorer

Solution to Review Problem 4.1

- Process costing

- Job costing

- Process costing

- Job costing

- Process costing

- Job costing