This is “Computerized Accounting Systems”, section 1.5 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

1.5 Computerized Accounting Systems

Learning Objective

- Understand how accounting systems can help organizations.

Question: Many companies today are growing out of their accounting systems. In the old days, accounting systems were designed primarily to track daily transactions and provide reports to external users on a monthly, quarterly, or annual basis. But times have changed, and companies now need more information internally to make good decisions. Accounting systems are currently used for both external reporting (financial accounting) and internal reporting (managerial accounting). Even relatively small accounting packages, such as QuickBooks and Peachtree, provide features that are important for managerial accounting. However, most agree that no single accounting system will meet the needs of every organization and that two important factors must be considered when choosing a system. What are the two factors that must be considered when deciding on an accounting system?

Answer: The two factors are (1) the size of the organization and (2) the information needs of the organization. Each factor is discussed next.

How Big Is Your Company?

Accounting software is designed to serve different-sized companies. The size of a company is commonly measured in sales revenue. Experts express varying opinions on what constitutes a small, midsized, or large company. Some believe that small companies have sales up to $10,000,000, midsized companies have sales up to $100,000,000, and large companies have sales greater than $100,000,000. Others prefer different amounts. Regardless of the number used, the goal is to find an accounting system that best meets the needs of the organization, and the size of the organization plays a big part in finding the best-fitting system.

What Information Is Needed?

Before selecting an accounting system, an organization must determine its accounting needs. Some organizations simply need the equivalent of a check register, which provides easy tracking of expense codes as checks are issued and makes bank reconciliations a snap. Other organizations require more than a check register; they may demand a system that can create invoices, process payroll, and track inventory. More complex organizations will want the ability to perform more advanced functions. Such organizations might need to customize reports (e.g., create an income statement by division or customer), modify input screens, send financial reports via e-mail, export reports to spreadsheet software such as Excel, and create reports with graphics (e.g., tables, pie charts, and line charts).

Enterprise Resource Planning System

Question: Clearly the size and information needs of a company will drive the selection of an accounting system for the company. As the need for accounting data has become more complex, accounting systems have been developed that perform a wide variety of tasks. These systems are called enterprise resource planning systems. What is an enterprise resource planning system, and how does this system help companies utilize accounting data?

Answer: Enterprise resource planning (ERP)A system designed to record and share information across functional and geographical areas to meet the needs of internal and external users. systems are designed to record and share information across functional areas (e.g., accounting, marketing, human resources, and shipping) and across geographical areas (e.g., from a sales office in California to headquarters in Hong Kong). ERP systems continually update information to provide real-time data to all users, and the data can be organized in different formats to meet the needs of internal and external users. For example, in his book Onward, Howard Schultz describes how as CEO of Starbucks he reviews comparative financial data for Starbucks stores daily. This information comes from the ERP system at Starbucks.

The idea behind ERP software, and a central theme in managerial accounting, is that accurate and up-to-date financial information will help organizations make better decisions. Better decisions typically lead to improvements in profitability, efficiency, and customer satisfaction.

ERP systems are expensive. Annual costs for large organizations can easily exceed $10,000,000. However, smaller systems for midsized companies are available at a much lower cost. Most ERP software is offered in modules for functional accounting areas, such as accounts receivable, accounts payable, payroll, inventory, and job costing. The more modules included, the higher the cost will be. Popular makers of ERP systems include Microsoft, Oracle, and SAP Corporation.

In deciding whether to upgrade to an ERP system, organizations must be sure that the benefits of using the data from a new system outweigh the costs of implementing the system. If management does not intend to use the information to improve planning and decision making, then going with a less sophisticated accounting system may be the better approach.

Using Spreadsheet Software

Question: ERP systems commonly provide a means to download data to spreadsheets for further analysis. How can spreadsheet software help us to analyze financial information?

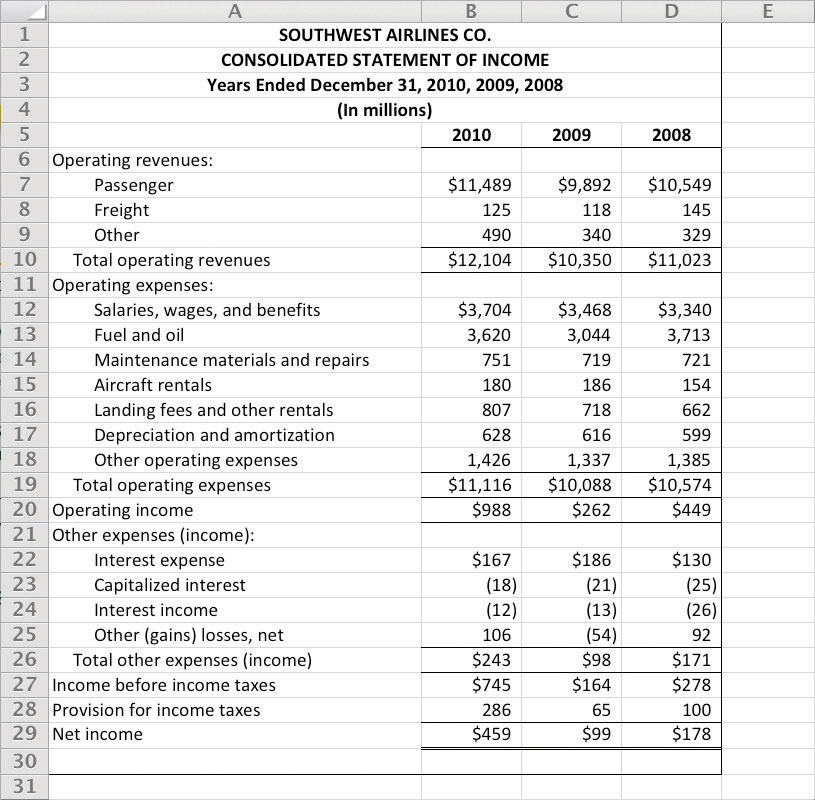

Answer: Since managers make extensive use of spreadsheets to organize and analyze data, most computerized accounting systems are designed to export data to spreadsheet software programs such as Excel. For example, Figure 1.3 "Excel Spreadsheet for Southwest Airlines" shows how a spreadsheet was used to import data directly from Southwest Airlines’ 2010 annual report. This allows the user to analyze the data more easily. Notice that in Figure 1.3 "Excel Spreadsheet for Southwest Airlines" the total operating revenue increased over the three years shown. We could use Excel to quickly determine the exact percentage increase from 2008 to 2009 and from 2009 to 2010.

Figure 1.3 Excel Spreadsheet for Southwest Airlines

Question: Let’s assume you are asked to prepare an income statement showing revenue and expense projections for next year. How might you use Excel to prepare your projections?

Answer: You could start by exporting this year’s results from the accounting system to an Excel spreadsheet. Then you could set up a new column to show estimates for next year. You would likely discuss different aspects of the income statement with various personnel in the organization—making changes as you go—before finalizing your projections.

Imagine the work involved if you did not use a computer but instead had to write the information down by hand. If there were any changes to the information, you would have to make time-consuming calculations, and once the data were finalized, you would be faced with the manual preparation of formal reports. With the relatively recent advances in business technology, the days of preparing information manually are over. Most organizations require their accounting and finance personnel to have advanced computer spreadsheet skills. Our goal is to provide you with an opportunity to use spreadsheets in a way that mirrors the real world.

Key Takeaway

- Throughout this text, you will learn about different methods of recording, sorting, analyzing, and reporting financial information for internal users. Before deciding to implement one of these methods, ask yourself the following question: Will the benefits derived from a new system, such as an ERP system, exceed the costs of putting the system in place? If the answer is “yes,” then go for it! If the answer is “no,” consider other alternatives.

Review Problem 1.5

Assume you are the CFO for an electronics consulting firm with annual revenues of $30,000,000 and annual profit of $5,000,000. The current accounting system is used for basic functions, such as issuing checks, creating invoices, and processing payroll. The company is considering upgrading its accounting system by purchasing an ERP system. Describe the factors to be considered by the company in making this decision.

Solutions to Review Problem 1.5

This company is a midsized company with $30,000,000 in revenues, although some would argue that this is a small company. Going to an ERP system is probably not appropriate if management is simply looking for a few reports beyond what most financial accounting systems can provide.

If management has a need for more detailed and complex financial information—other than processing checks, invoices, and payroll—then a low-end ERP system might be appropriate. However, the benefits derived from such a system must outweigh the costs.