This is “The Tools of the Fed”, section 10.5 from the book Theory and Applications of Macroeconomics (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

10.5 The Tools of the Fed

Learning Objectives

After you have read this section, you should be able to answer the following questions:

- What do banks do?

- What are the tools of the Fed?

We have not yet said very much about exactly how the Fed changes interest rates. The Fed has three major tools at its disposal: open-market operations, the reserve requirement, and the discount rate. We discuss these in turn. Monetary policy operates through the Fed’s interactions with the banking system, so we first must make sure we understand what banks do in the economy.If your find this material interesting, a course on Money and Banking will delve much further into the details of how banks operate and how they interact with the monetary authority. Throughout this discussion, we use the credit market to think about how the Fed operates.

Toolkit: Section 16.4 "The Credit (Loan) Market (Macro)"

You can review the workings of the credit market in the toolkit.

What Do Banks Do?

Financial markets (that is, banks and other financial institutions) provide the link between savings and investment in the economy. A bank is a profit-making entity that takes in deposits from households and firms and makes loans to firms, households, and the government.

Banks can be fragile institutions.The fragility of banks is discussed in more detail in Chapter 7 "The Great Depression". They must ensure that their depositors are not worried that the bank might go out of business, taking their money with it. Banks do many things to ensure that their customers have confidence in them. Perhaps the most important is that they keep a certain amount of their assets in a very liquid form, such as cash. This means that if a depositor comes in to withdraw his or her money, the bank will be able to meet that demand. These liquid deposits are called the reservesDeposits received by a bank that it must set aside rather than loan to firms and households. of the bank.

Most banks in the United States are members of the Federal Reserve System. This membership comes with a responsibility to hold some fraction of deposits on reserve. This is called a reserve requirementThe level of reserves that the monetary authority requires a bank to hold..Current reserve requirements are at “Reserve Requirements,” Federal Reserve, accessed September 20, 2011, http://www.federalreserve.gov/monetarypolicy/reservereq.htm#table1. Reserve requirements limit the amount of deposits that banks are able to loan out to firms and households. Suppose a bank has $1,000 on deposit and the reserve requirement is 10 percent. Then the bank must hold at least $100 on reserve and can loan out at most $900. We say “at least $100” since the bank is free to hold more than 10 percent on reserve. In uncertain times, when a bank is unsure how many depositors are likely to want to withdraw their money, the bank may choose to keep reserves above and beyond the level required by the Fed.

What does a bank do if it finds itself with insufficient reserves on a given day to meet its reserve requirements? The answer is that it borrows—either from other banks or from the Federal Reserve itself. Because the Federal Reserve can influence the interest rates at which banks borrow, it can influence the behavior of banks.

Open-Market Operations

In the memo with which we opened the chapter, the Federal Open Market Committee (FOMC) decided to increase the target federal funds rate to 2.5 percent. But what exactly does this mean, and how did the Fed accomplish it? The federal funds rate is the interest rate in a particular market—the market where banks make overnight loans to each other. Overnight loans, as the name suggests, are assets that have a very short time to maturity (one day). The interest rate on these loans is therefore one of the “shortest” interest rates in the economy, which is why it is targeted by the Fed. The interest rate is so named because the loans are made using the funds that banks have available in their accounts at the Federal Reserve.

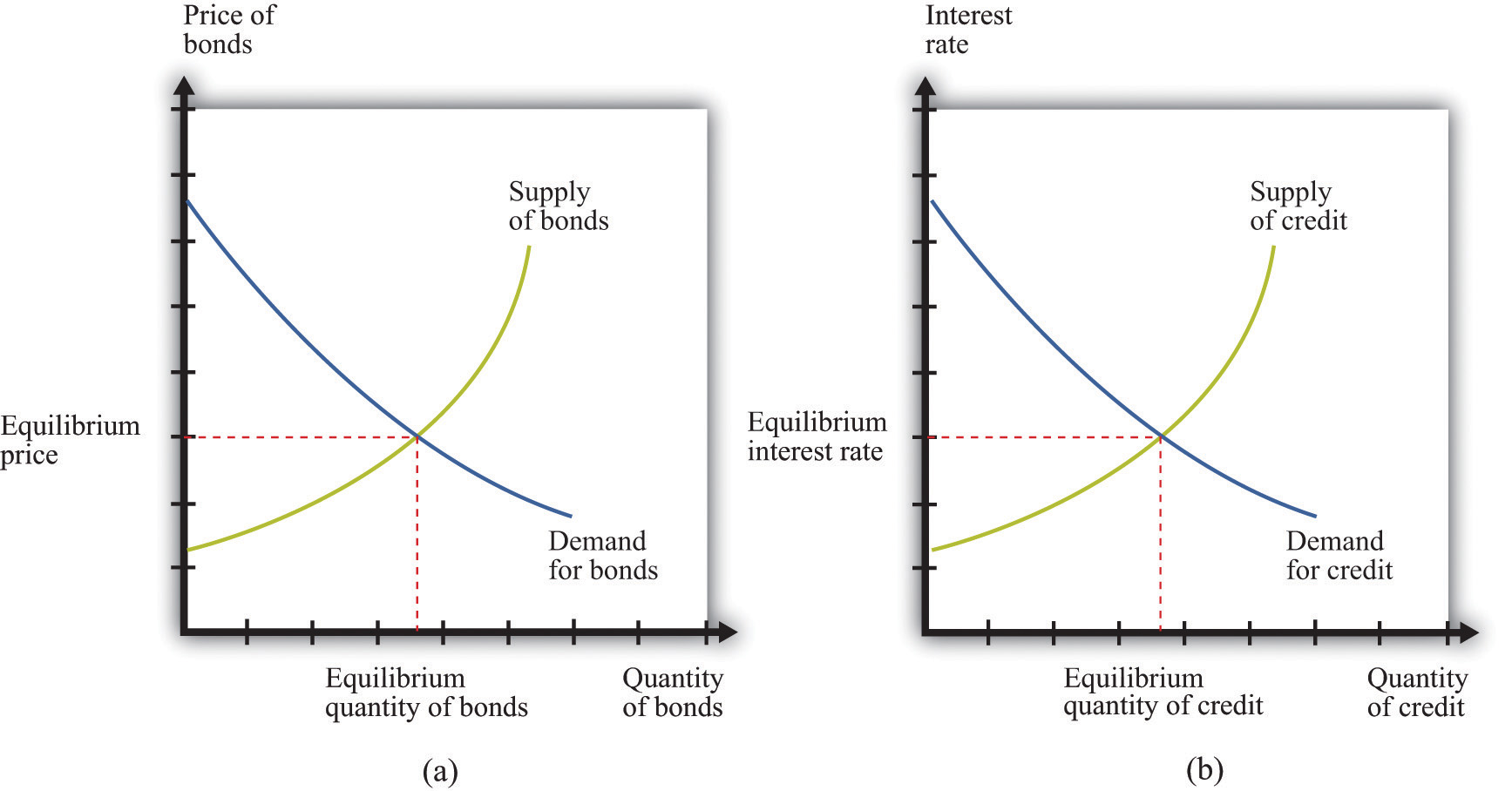

The Federal Reserve does not participate directly in this market. It influences the federal funds rate by buying and selling in a different market—the market for short-term government debt. These purchases and sales are called open-market operationsPurchases and sales of government debt by a central bank..Section 14 of the Federal Reserve Act describes open-market operations. Let us examine how this works. The effect of open-market operations can be seen in the market for government debt. Part (a) of Figure 10.18 "The Market for Government Bonds" shows the supply and demand of this asset. The horizontal axis shows the quantity of assets (think of this as the amount traded on a given day), and the vertical axis shows the price of those assets. The participants in this market are financial institutions and others who hold, or want to hold, bonds as part of their portfolio of assets. Current owners will be willing to sell bonds if their price is sufficiently high. Conversely, if the price of bonds decreases, more people will want to purchase them. The same institution could be either a supplier or a demander, depending on the price. It is perfectly possible that a financial institution would want to buy bonds if their price were low and sell them if their price were high.

Figure 10.18 The Market for Government Bonds

(a) The price of bonds is determined by supply and demand. (b) These same transactions are represented in a credit market, which is another way of looking at exactly the same market.

Part (b) of Figure 10.18 "The Market for Government Bonds" shows the equivalent representation of this as a credit market. When the Fed buys bonds, it is making a loan. When the government or private investors sell bonds to the Fed, they are borrowing from the Fed. The crossing of the supply and demand curves tells us the equilibrium price of government bonds. It also tells us how many bonds changed hands that day, but our interest here is in what is happening to prices.

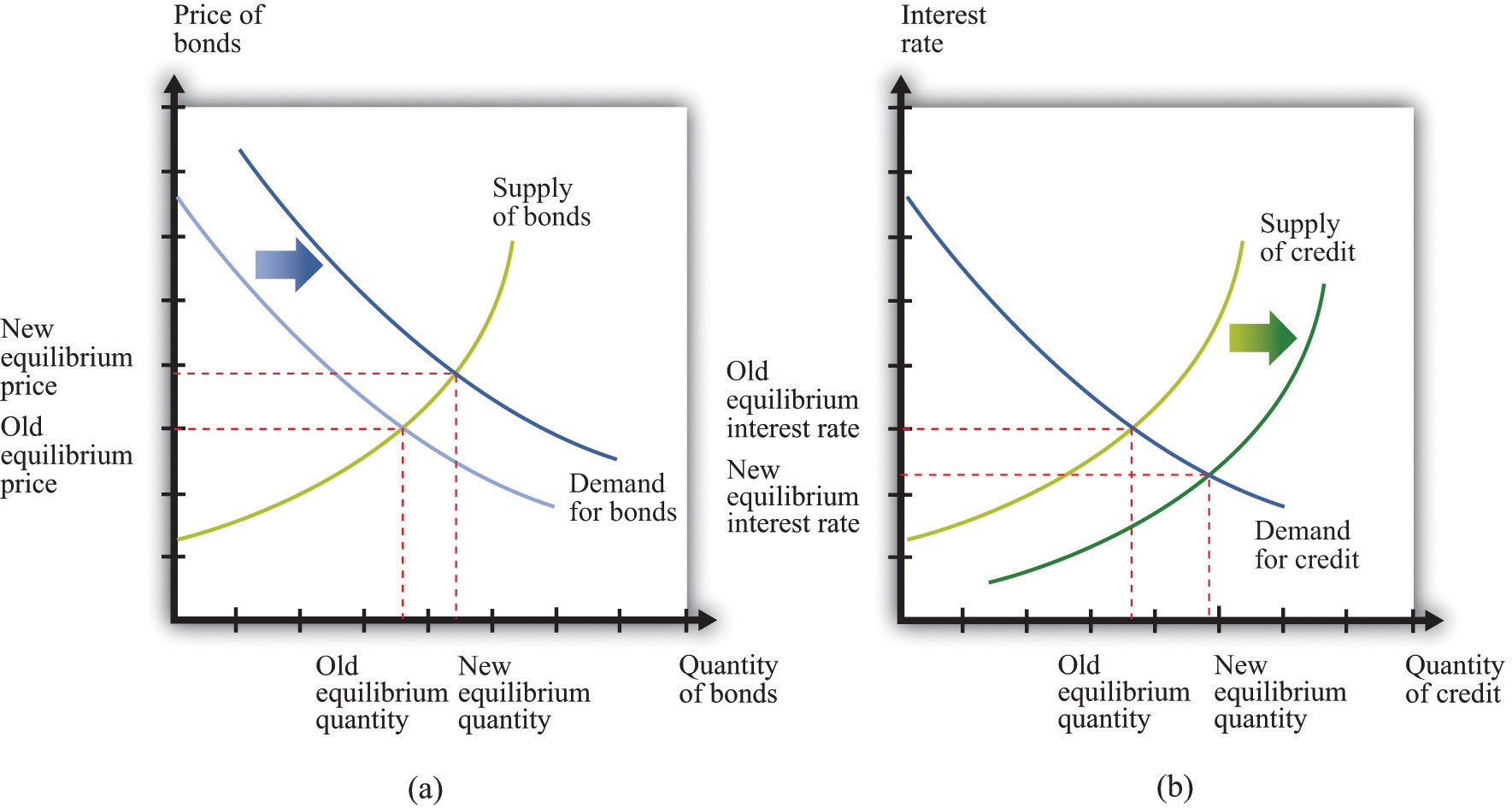

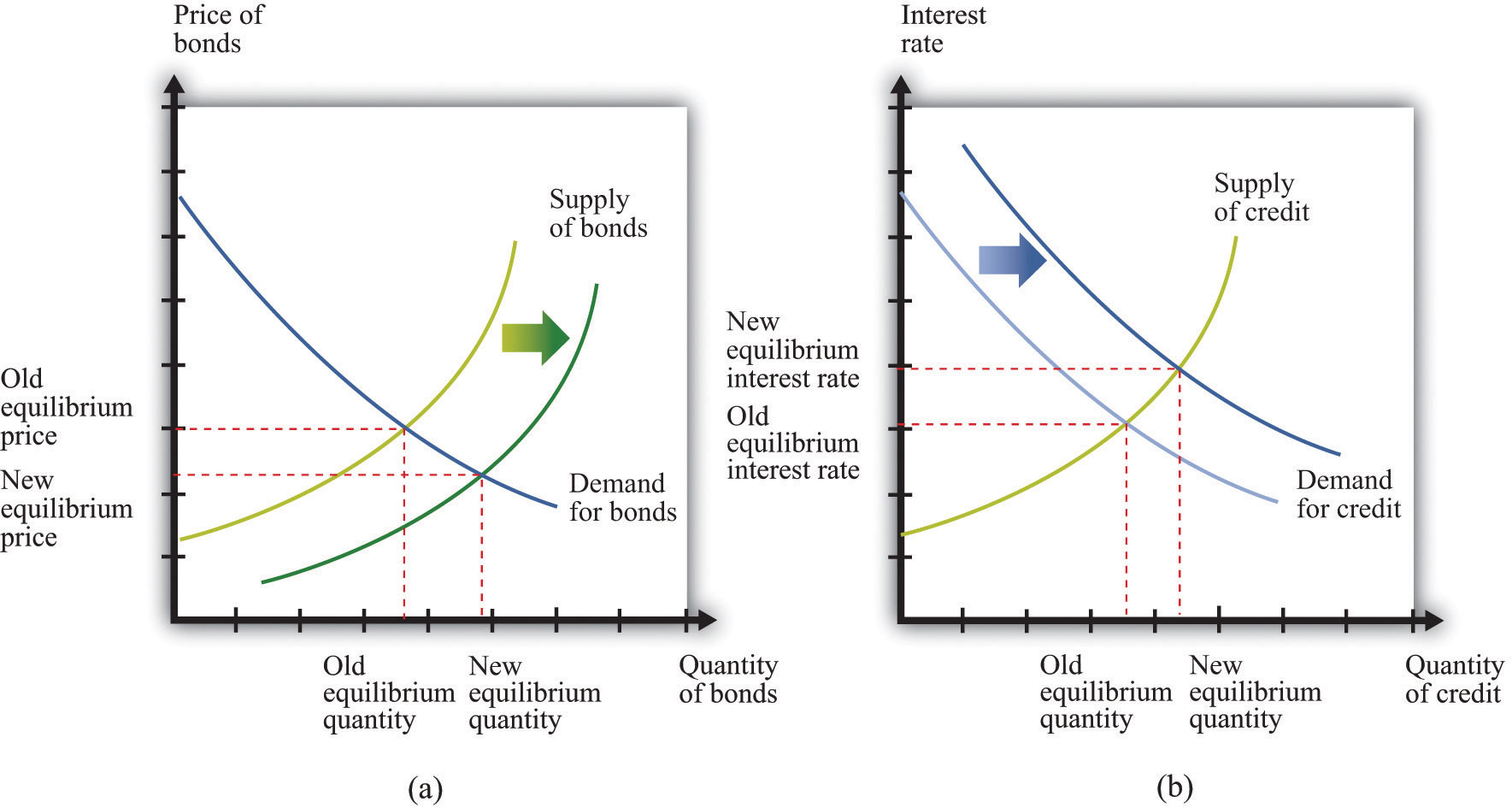

Now suppose the Federal Reserve steps into this market and buys some government bonds. This increases the demand for bonds, so the price of bonds will increase. This is shown in part (a) of Figure 10.19 "Intervention by the Federal Reserve". Part (b) of Figure 10.19 "Intervention by the Federal Reserve" shows the same action viewed through the lens of a credit market. Conversely, if the Fed decides to sell some of its stock of government bonds, the supply of bonds will shift out, and the price of bonds will decrease (see Figure 10.20 "Intervention by the Federal Reserve").

Figure 10.19 Intervention by the Federal Reserve

When the Federal Reserve conducts an expansionary open-market operation, it purchases bonds (a) or, equivalently, supplies more credit (b). The price of bonds increases, or, equivalently, the interest rate decreases.

Figure 10.20 Intervention by the Federal Reserve

When the Federal Reserve conducts a contractionary open-market operation, it sells bonds (a) or, equivalently, demands more credit (b). The price of bonds decreases, or, equivalently, the interest rate increases.

Thus the Federal Reserve, by buying or selling government bonds in this market, has the ability to influence the price of bonds. This means that it can affect the interest rate on those bonds.

From this relationship, we know the following:

- If the Fed buys bonds, then the price of bonds increases, and interest rates decrease.

- If the Fed sells bonds, then the price of bonds decreases, and interest rates increase.

The Fed’s actions in this market have an effect on interest rates in other markets, as banks and other financial institutions adjust their portfolios in response to the changing interest rate on government bonds. The Fed calibrates its buying and selling to try to achieve its target interest rate in the federal funds market.

The Discount Rate

The February 2005 announcement by the FOMC also included an increase in the discount rate. The discount rate is the interest rate from another market—in this case a market established by the Fed itself.

We have said that if a bank is short on reserves, it can borrow. One source of loans is the federal funds market. Another source of loans is the Fed itself. Member banks have the privilege of borrowing from the Fed, and the rate at which a bank can borrow is called the discount rateThe interest rate paid by banks on loans from the Fed.. The Fed directly controls this interest rate. The Federal Reserve’s policies on such loans are set out in “Regulation A” of the Fed’s Board of Governors: “A Federal Reserve Bank [that is, a Regional Fed] may extend primary credit on a very short-term basis, usually overnight, as a backup source of funding to a depository institution that is in generally sound financial condition in the judgment of the Reserve Bank. Such primary credit ordinarily is extended with minimal administrative burden on the borrower.”“Regulation A (12 C.F.R. 201 as amended effective December 9, 2009),” Federal Reserve, accessed July 20, 2011, http://www.frbdiscountwindow.org/regulationa.cfm?hdrID=14&dtlID=77. Once a bank has established the right to borrow at the Fed’s “discount window,” the execution of such a loan is straightforward. The bank simply makes a toll-free call and provides a few pieces of basic information.

To see how this tool works, suppose the discount rate were very high, much higher than the interest the bank can earn by making a loan. Then the bank would find it prohibitively expensive to borrow from the Fed. If the bank were unsure that it could meet the needs of depositors, it would respond by holding reserves in excess of the reserve requirement. That is, with a very high discount rate, the bank would lend out a smaller fraction of its deposits. By contrast, if the Fed were to set the discount rate very low, the bank would make more loans and hold fewer reserves, safe in the knowledge that it could always borrow from the Fed if necessary.

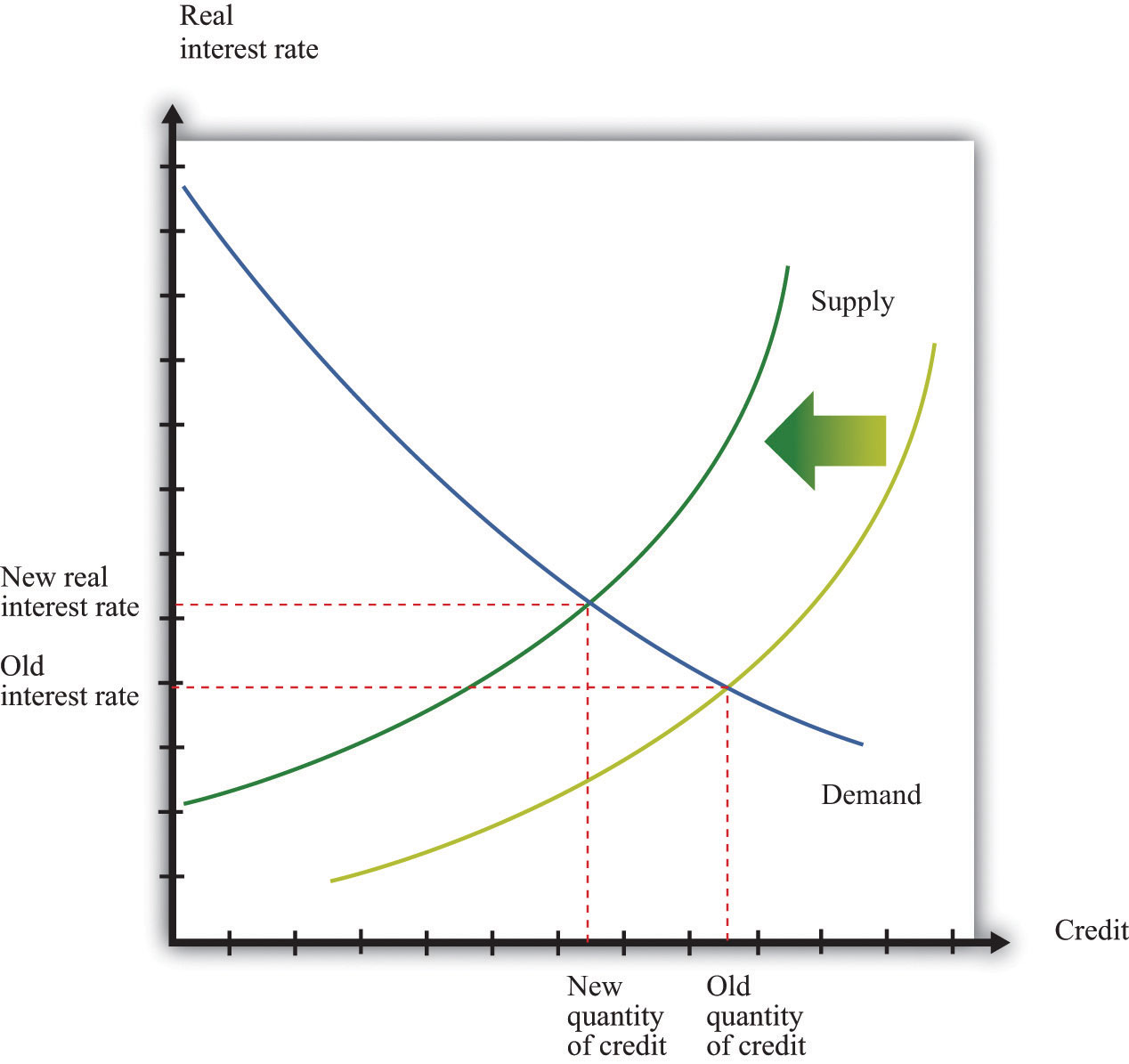

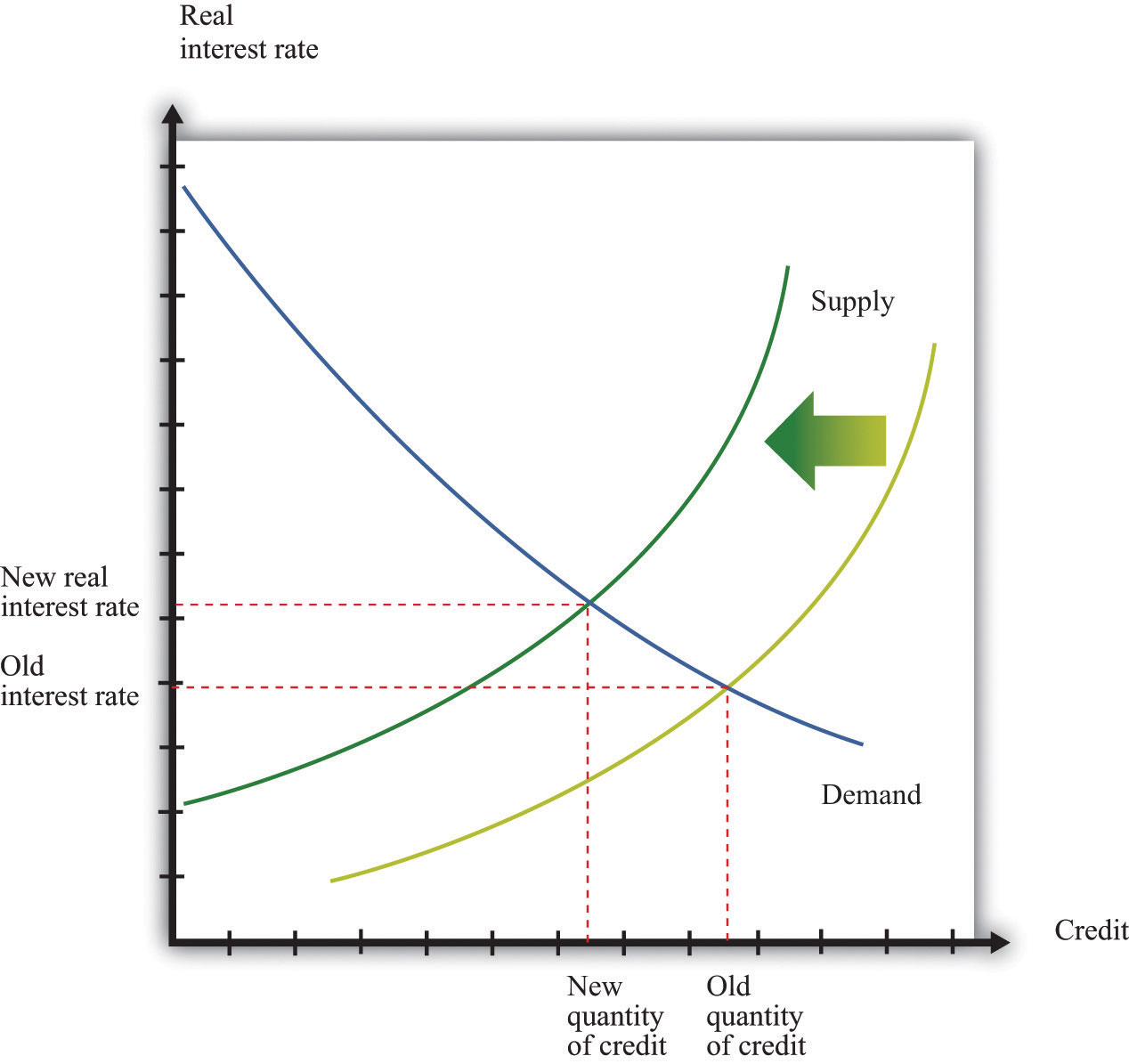

From this reasoning, we can see that as the discount rate is increased, banks hold more excess reserves and lend less. This shows up in Figure 10.21 "An Increase in the Discount Rate" as a shift inward in the supply of credit. Thus the Fed can increase interest rates by increasing the discount rate.

Figure 10.21 An Increase in the Discount Rate

An increase in the discount rate reduces the supply of credit and therefore increases the real interest rate.

Reserve Requirements

Reserve requirements are outlined in Section 19 (A) of the Federal Reserve Act:

(A) Each depository institution shall maintain reserves against its transaction accounts as the Board may prescribe by regulation solely for the purpose of implementing monetary policy—

- in the ratio of 3 per centum for that portion of its total transaction accounts of $25,000,000 or less, subject to subparagraph (C); and

- in the ratio of 12 per centum, or in such other ratio as the Board may prescribe not greater than 14 per centum and not less than 8 per centum, for that portion of its total transaction accounts in excess of $25,000,000, subject to subparagraph (C) [which stipulate that the reserve requirements could be changed].

Suppose the Fed were to increase the reserve requirement from 10 percent to 20 percent. In the previous example, all else being the same, a bank with deposits of $1,000 would be required to have at least $200 on deposit, rather than the $100 that was required originally. To fulfill this larger reserve requirement, the bank would be allowed to lend only $800 at most. Banks therefore respond to an increase in the reserve requirement by holding a larger fraction of deposits on reserve and lending out a smaller fraction of their deposits. This reduces the supply of credit in the economy since a smaller fraction of saving is actually being lent.

As shown in Figure 10.22 "An Increase in Reserve Requirements", the supply of credit shifts inward, and the interest rate increases. This picture is exactly the same as Figure 10.21 "An Increase in the Discount Rate". When we think about the credit market, the increase in the discount rate and the increase in the reserve requirement have the same effect. Thus we learn that the Fed can increase interest rates by increasing the reserve requirement. Often, increases in the reserve requirement are coupled with other measures, such as open-market operations, to increase interest rates. A decrease in the reserve requirement works in a symmetric fashion, though in the opposite direction.

Figure 10.22 An Increase in Reserve Requirements

An increase in reserve requirements reduces the supply of credit and therefore increases the real interest rate.

Key Takeaways

- Banks act as intermediaries, taking the deposits of households and making loans to firms and households who wish to borrow. Banks also borrow from other banks and from the Fed.

- The main tools of the Fed are as follows: (a) open-market operations, (b) lending at the discount rate to member banks, and (c) setting the reserve requirements on member banks.

Checking Your Understanding

- Can a bank borrow from the Fed?

- What are reserve requirements?

- In an open market sale, does the money supply increase or decrease?